With the bitcoin price punching through $14,000, investors are reminiscing about the 2017 bull run and see the all-time high of nearly $20,000 within grasp. Most recently, the cryptocurrency community has been gripped by the possibility that Elon Musk might have a bitcoin ATM located at the Tesla Gigafactory in Sparks, Nev. It started with a single tweet and grew to eventually capture the attention of tech entrepreneur Musk himself, who said that the reports might be off.

Nonetheless, the company behind the machine, LibertyX, hints that there may, in fact, be a bitcoin ATM in the cafeteria of the Gigafactory. When asked about the fees, Jason Jawn, who is an ATM integration advisor at LibertyX, replied that it’s 8%, mildly reasonable compared to some of the other machines out there. The fact that this one bitcoin ATM has piqued the interest of the community speaks to the pivotal role that these machines have the potential to play in the market. And the fees tied to these transactions could either make or break their future.

Sky-high fees stifle Bitcoin ATM growth

Since the first bitcoin ATM made its debut in a Vancouver coffee house seven years ago, the mission has been the same: provide people — many of whom are part of the millions of households that are either unbanked or underbanked — with a fluid, fast and convenient gateway to cryptocurrencies. Bitcoin ATMs are an implementation of what Satoshi Nakamoto envisioned in his 2008 whitepaper, in which he said,

“A purely peer-to-peer version of electronic cash would allow online payments to be sent directly from one party to another without going through a financial institution.”

With access to a bitcoin ATM, users are able to get off the sidelines and participate in the types of returns that many investors have been experiencing already, with the bitcoin price up by more than 67% year-to-date. They get the opportunity to save, store value, invest and generate returns that were once elusive to them. In a nutshell, the benefits of being able to access BTC via a bitcoin ATM are twofold:

gaining control over one’s financial future, a feature that is inherent with having the keys to one’s own bitcoin wallet, and protection from being vulnerable to predators on a third-party banking platform.

There is a great deal to be protected from. And while the unbanked population might not be privy to some of the same financial products as others, the signs increasingly suggest that they might be better off. A Cincinnati-based bank is one of many examples.

A former bank employee of Fifth Third has come out swinging, accusing Fifth Third of unscrupulous sales tactics and acting as a “predatory financial institution” at the expense of unsuspecting customers. He says that the bank made it a common practice to persuade customers to open multiple checking accounts instead of just one, placing them at greater risk of overdrawing their accounts and being slapped with fees and monthly charges as a result. The former employee claims that it wasn’t uncommon for him to uncover one or two victims of this practice on a weekly basis.

It is this lack of trust in the legacy financial institution that has drawn so many people to bitcoin around the world. The Bitcoin ATM market should be at their best, and yet unreasonably high fees could spoil the party. Something that Jordan Spence, chief marketing officer at MyCrypto, recently said of Ethereum, might also apply to bitcoin ATMs, which is that the only thing that has the ability to kill them is the companies behind the bitcoin ATMs themselves.

Bitcoin ATM fee landscape

The number of bitcoin ATMs globally has ballooned from fewer than 350 in March 2015 to more than 10,500 as of October 2020. Much of the growth has occurred this year, as the COVID-19 pandemic has turned the money printers on at the Federal Reserve and central banks around the world. Despite the meteoric rise in the number of bitcoin ATMs in 2020, sky-high fees threaten to stifle the growth of this trend.

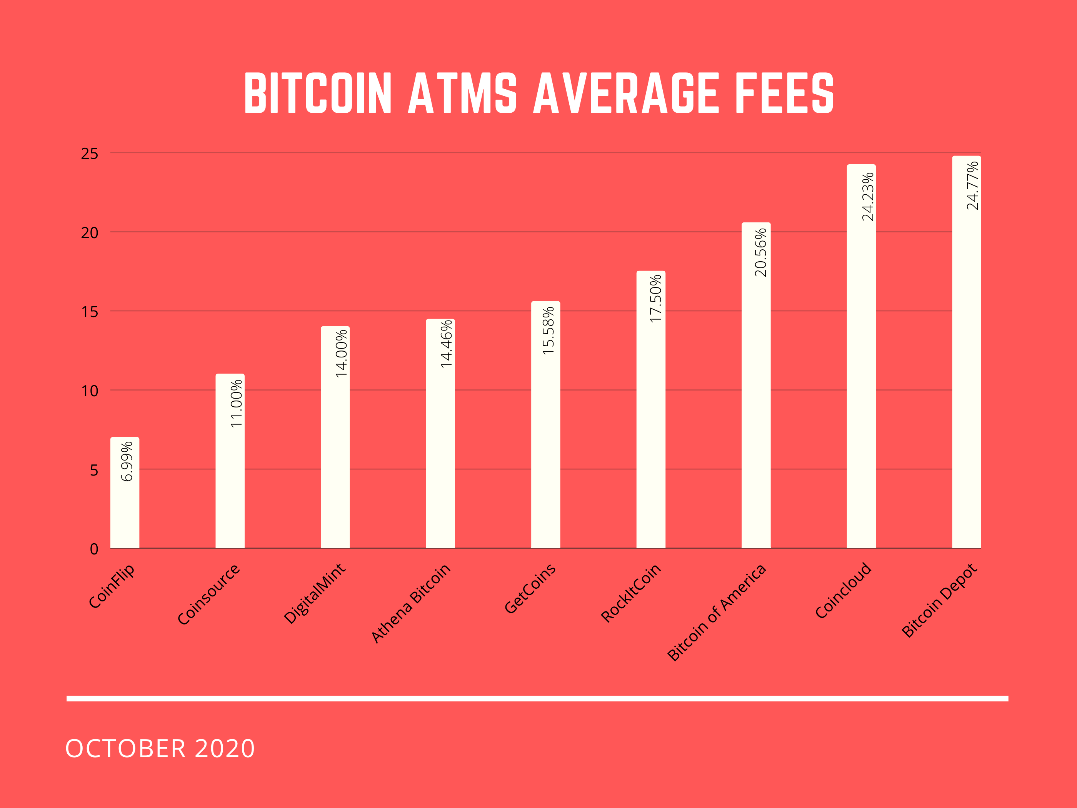

Meanwhile, high fees are the antithesis of what bitcoin was created to be for people. Worse, these taxing charges are more of a reflection of the very banks that prey on the marginalized than they are the mission of bitcoin. Low transaction fees are supposed to be one of the key benefits of using cryptocurrencies. Yet, many BTM operator fees have climbed above the 20% threshold, in some cases reaching as high as nearly 25%, ultimately shutting out (even taking advantage of) the very people that these machines are designed to benefit.

Even some leading operators have been accused of exorbitant fees and price hikes exceeding 20% of the transaction value. Others have been accused of not appropriately revealing their transaction costs. Some commentators have even hinted that anyone charging over 20% for transactions “is making a trade-off for relaxed identity verification processes, implicitly encouraging illegal activity.”

Spirit of Satoshi

Fortunately, there are some market players that are here for the right reasons and whose model is representative of what Satoshi Nakamoto had in mind when he created bitcoin. Both CoinFlip and Coinsource boast the lowest transaction fees on the market.

CoinFlip’s ATMs, of which there are more than 1000 locations and counting across 45 states, includes a 6.99% transaction fee over the spot price for purchases and 3.99% under spot for sales – these are some of the lowest BTM fees in the US. Coinsource ranks second with 11% fees.

If the purpose of BTMs are to empower the underbanked populations, then high transaction fees are not the answer. Excessive fees not only take advantage of the marginalized, but they are entirely contrary to the founding principles of Bitcoin.

I want to buy bitcoins at your atm but you banned me. I want to know why. My husband and I are trying to invest on bitcoins.