The trillion-dollar company had a shaky entrance into the New Year. On January 2, Apple’s CEO Tim Cook announced in a press release to shareholders that the company is expecting a $49 billion drop in its revenue for the first quarter of this year.

Here is what Apple is expecting:

- Revenue of approximately $84 billion

- A gross margin of approximately 38 percent

- Approximately $8.7 billion of operating expenses

- Other income/ expense of approximately $550 million

- A tax rate of approximately 16.5 percent before discrete items

Cook further revealed that the flagship product of Apple, the iPhone, was unable to reach expected sales goals. He said that 2018 was its toughest year since the product came to market.

After sending the letter to investors, Cook announced he would hold a meeting to brief his employees about the situation and take their questions later in the week. According to some analysts, this is going to be the “most defining moment of Cook’s career.”

Bloomberg’s Michael Gartenberg, a former marketing executive of Apple said:

“This is probably one of the hardest things Tim Cook had to do as a CEO, putting out that letter today.”

Cook reported that the situation was partly the result of declining iPhone sales in China. He said the company had failed to foresee the “magnitude of economic deceleration in China,” which began in the second half of 2018. Also, rising trade tensions between China and the US have worsened the economic environment in China. Despite all these factors, Cook said that he is still hopeful about a bright future in the Chinese market as the developer community in China is the most innovative and creative one in the world.

Cook says:

“While Greater China and other emerging markets accounted for the vast majority of the year-over-year iPhone revenue decline, in some developed markets, iPhone upgrades also were not as strong as we thought they would be. While macroeconomic challenges in some markets were a key contributor to this trend, we believe there are other factors broadly impacting our iPhone performance, including consumers adapting to a world with fewer carrier subsidies, US dollar strength-related price increases, and some customers taking advantage of significantly reduced pricing for iPhone battery replacements.”

While this might not seem like a disaster for a trillion dollar company, the situation has raised concerns among investors as Apple received its first earning warning in 17 years.

However, despite all this tension, Cook has maintained his trademark calm attitude. He is hopeful and confident that the core strength of his business will pull the company out from these crises. He appears quite positive that the creativity, compassion, flexibility, and adaptability of Apple’s workers can help the company emerge better than ever before.

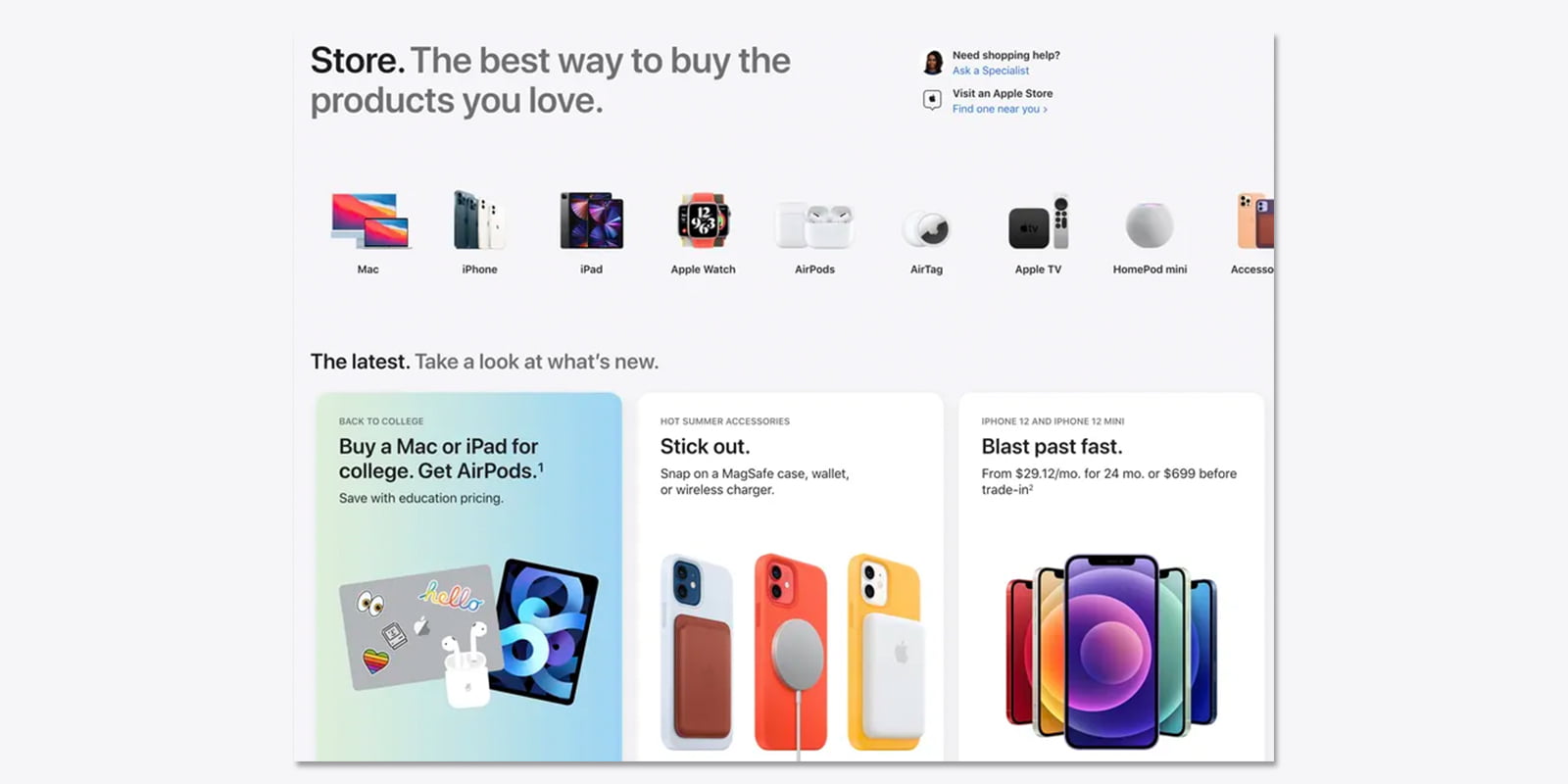

Cook also hinted at a new line of products. And it’s just in time, as it looks like Apple might need a new strategy where it relies on more than iPhones alone.

Let’s what strategic planning Apple will do to cope. Until then, stay tuned!

Share Your Thoughts